Since this page is automatically translated by the machine, it may be less accurate than human being's work.

National Tax Service_ Earned Income Percentile (thousandth percentile) data

Employment income is generally income (salary, wages, compensation, taxes, bonuses, compensation for job inventions, etc.) received in return for providing labor, which is a non-independent personal service, through an employment relationship or a similar contract, and is distinguished from business income, other income, and retirement income. (Employment income) Payment received for providing labor through an employment relationship or a similar contract → Withholding tax according to the simplified tax table (Business income) Payment received for continuously providing services in an independent capacity without an employment relationship → Withholding tax of 3% of the income amount (Other income) Payment received for temporarily providing services → Withholding tax of 20% of the other income amount (income amount - necessary expenses) (Retirement income) Income paid due to actual retirement based on employer contributions, etc. → Withholding tax upon retirement Employment income percentile (top 1%, 1,000th percentile) data - Number of people - Total salary amount (100 million won) - Employment income amount (100 million won) - Income deduction amount (100 million won) (Employment income deduction + Personal deduction + Pension insurance premium deduction + Special income deduction + Other income deduction - Amount exceeding income deduction limit) - Taxable standard (100 million won) - Determined tax amount (100 million won) This is the value of the total employment income for each quintile, and is expressed in 0.1% units only within the top 1%.

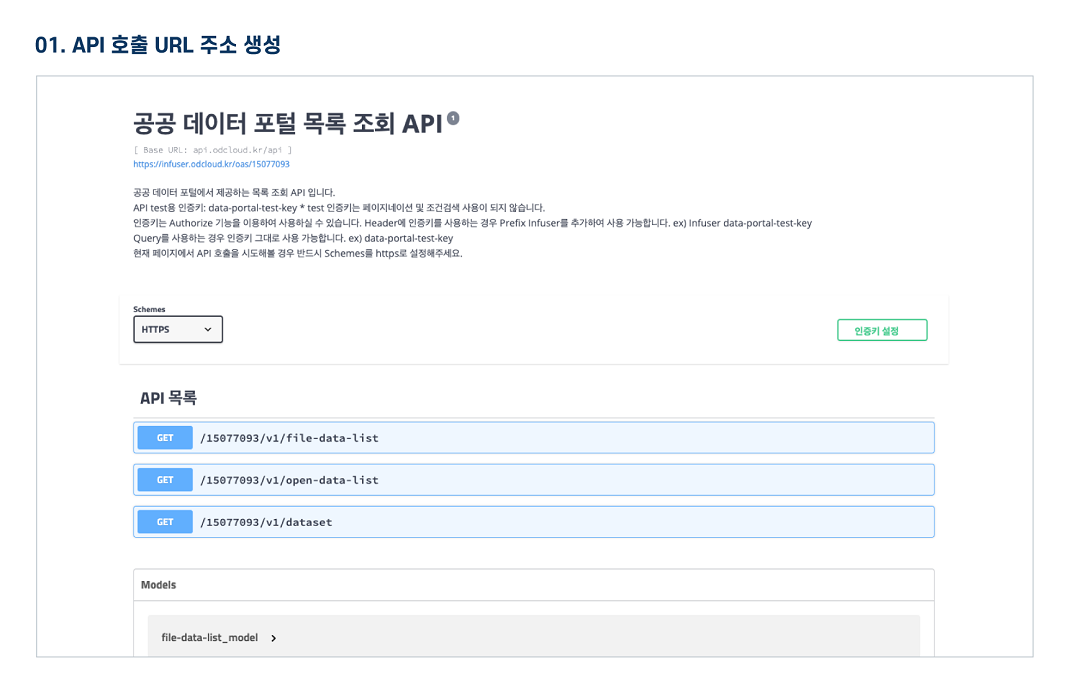

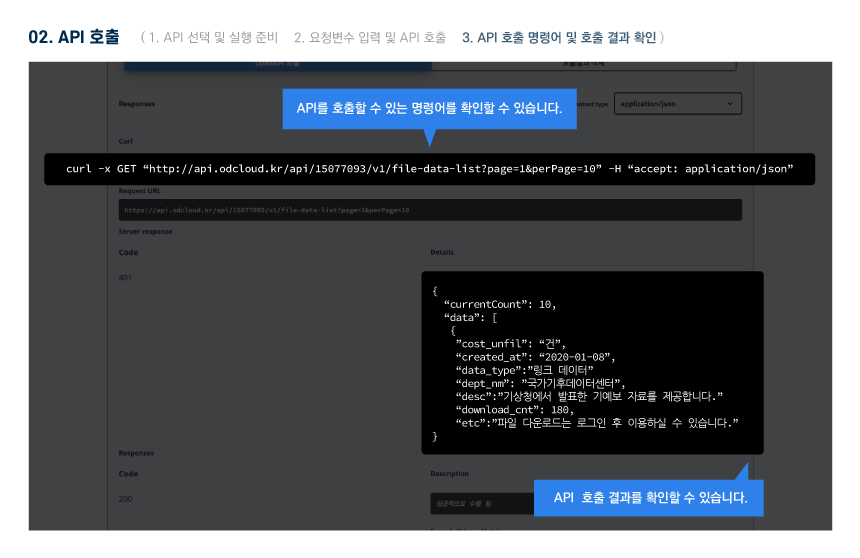

The Public Data Utilization Support Center automatically converts and provides open-format file data of three or more steps open to public data portals into open APIs (RestAPI-based JSON/XML).

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

National Tax Service_ Earned Income Percentile (thousandth percentile) data

File data information Download metadata Provides schema.org based metadata.

The Public Data Utilization Support Center automatically converts and provides open-format file data of three or more steps open to public data portals into open APIs (RestAPI-based JSON/XML).

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

National Tax Service_ Earned Income Percentile (thousandth percentile) data

Open API Information Download metadata Provides schema.org based metadata.

| Service | National Tax Service _ Earned Income Percentile (thousandth percentile) data (attributed in 2019)_20210131 | ||

|---|---|---|---|

| Classification System | Finance, tax, and finance - Detergent | Provider | |

| Management Agency | Public Data Utilization Support Center | Management agency phone number | 1566-0025 |

| Basis For Retention | Collection Method | ||

| Update Cycle | yearly | Next Enrollment Date | 2026-02-27 |

| Media Type | Text | Whole Row | 109 |

| Extension | XML, JSON | Application For Use | 31 |

| Data Limit | Here are the 2024 report data for your 2023 earned income. | Keyword | Earned income,Percentile,Top 1%,total,Annual salary |

| Enrollment | 2025-02-25 | Correction | 2025-06-02 |

| Form Of Provision | Download from open data Portal (the original text file registration) | ||

| Explanation | Employment income is generally income (salary, wages, compensation, taxes, bonuses, compensation for job inventions, etc.) received in return for providing labor, which is a non-independent personal service, through an employment relationship or a similar contract, and is distinguished from business income, other income, and retirement income. (Employment income) Payment received for providing labor through an employment relationship or a similar contract → Withholding tax according to the simplified tax table (Business income) Payment received for continuously providing services in an independent capacity without an employment relationship → Withholding tax of 3% of the income amount (Other income) Payment received for temporarily providing services → Withholding tax of 20% of the other income amount (income amount - necessary expenses) (Retirement income) Income paid due to actual retirement based on employer contributions, etc. → Withholding tax upon retirement Employment income percentile (top 1%, 1,000th percentile) data - Number of people - Total salary amount (100 million won) - Employment income amount (100 million won) - Income deduction amount (100 million won) (Employment income deduction + Personal deduction + Pension insurance premium deduction + Special income deduction + Other income deduction - Amount exceeding income deduction limit) - Taxable standard (100 million won) - Determined tax amount (100 million won) This is the value of the total employment income for each quintile, and is expressed in 0.1% units only within the top 1%. | ||

| Other Notes | |||

| Payment | free | Charge Standard And Unit | Case |

| Scope Of Use | The use permission range limitless | ||

Usage Specification

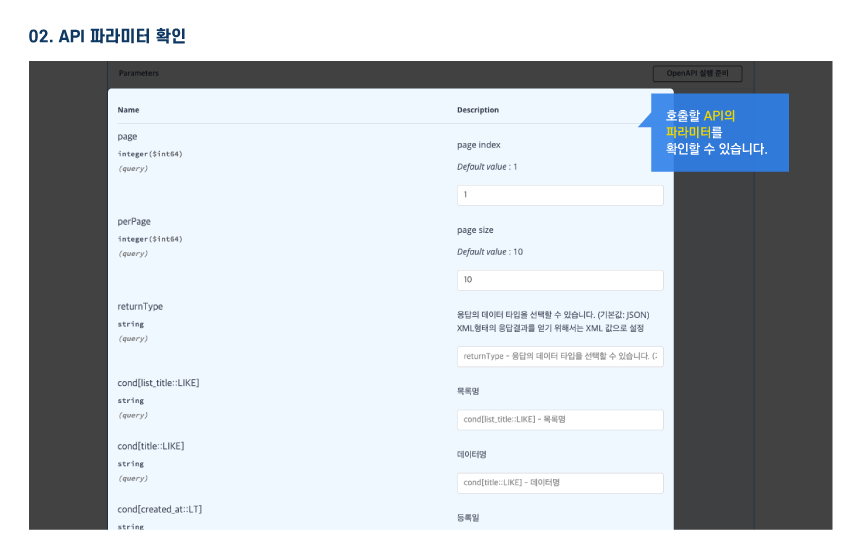

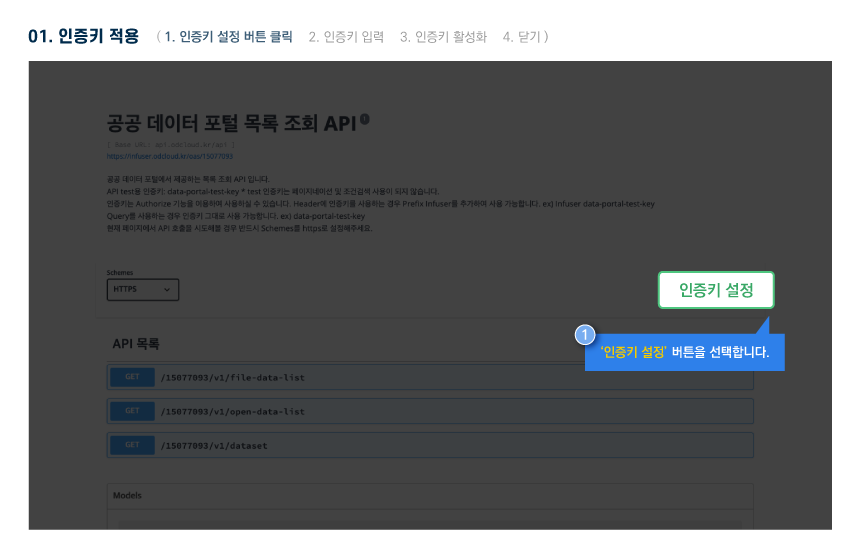

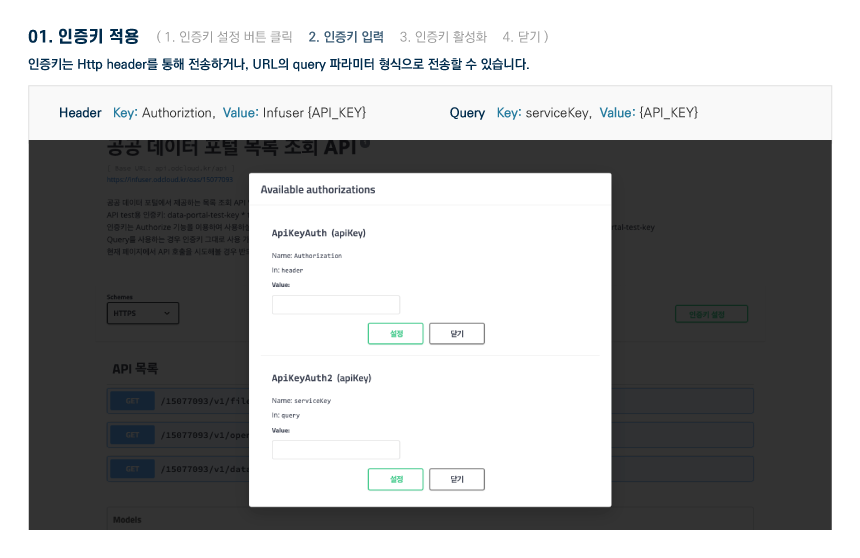

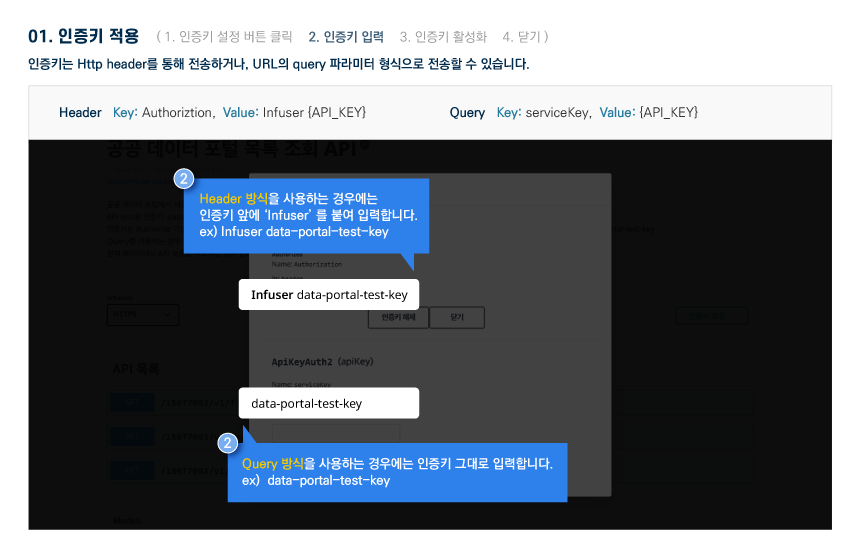

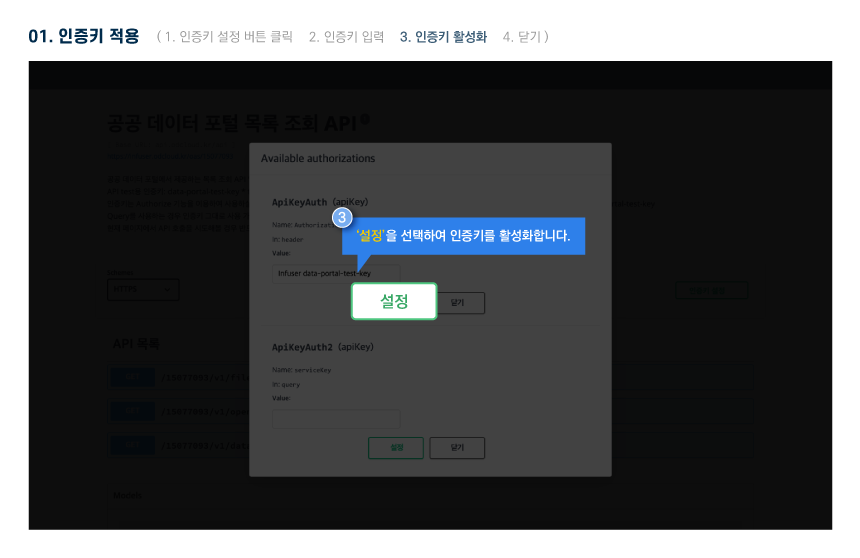

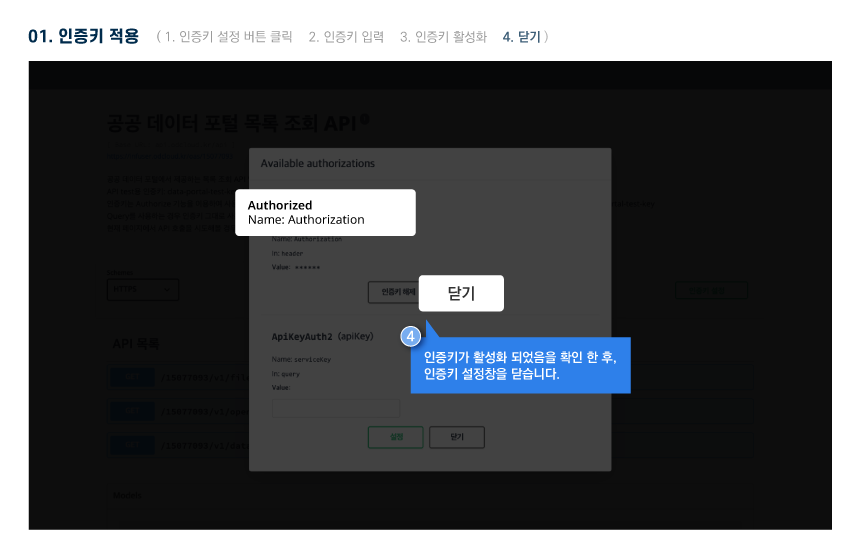

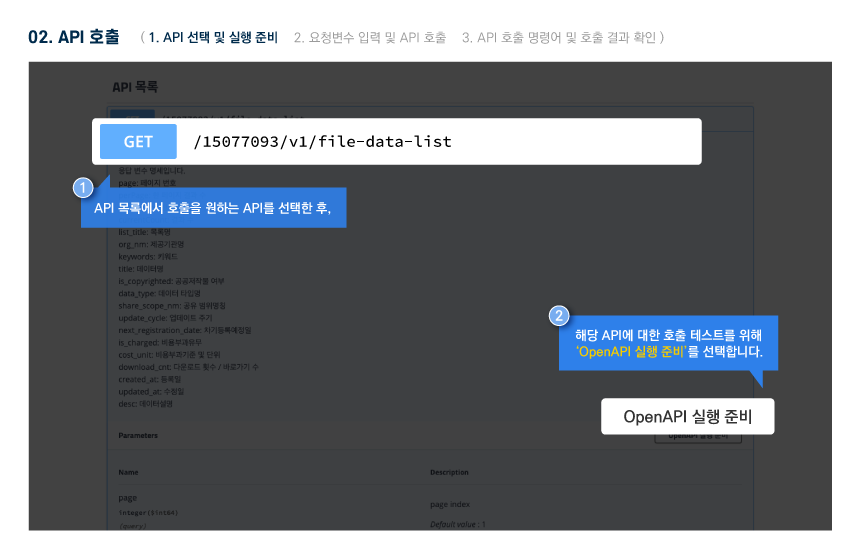

Open API 명세 확인 가이드