Since this page is automatically translated by the machine, it may be less accurate than human being's work.

Nonsan City, Chungcheongnam-do_1 Local tax burden per capita

This data provides per capita local tax burden data for Nonsan City, South Chungcheong Province. Key data includes city/province names, city/county/district names, local government codes, tax year, per capita burden, per household burden, total local tax, population, and number of households. This allows for quantitative analysis of the scale and trends of local taxes borne by Nonsan citizens and households. It is also useful for assessing regional fiscal soundness and understanding the level of resident burden and the structure of local tax revenue. This data serves as essential foundational data for various administrative fields, including fiscal policy formulation, revenue forecasting, resident welfare budgeting, and tax reform discussions. It provides transparent information disclosure to citizens and contributes to strengthening the fiscal accountability and policy responsiveness of local governments.

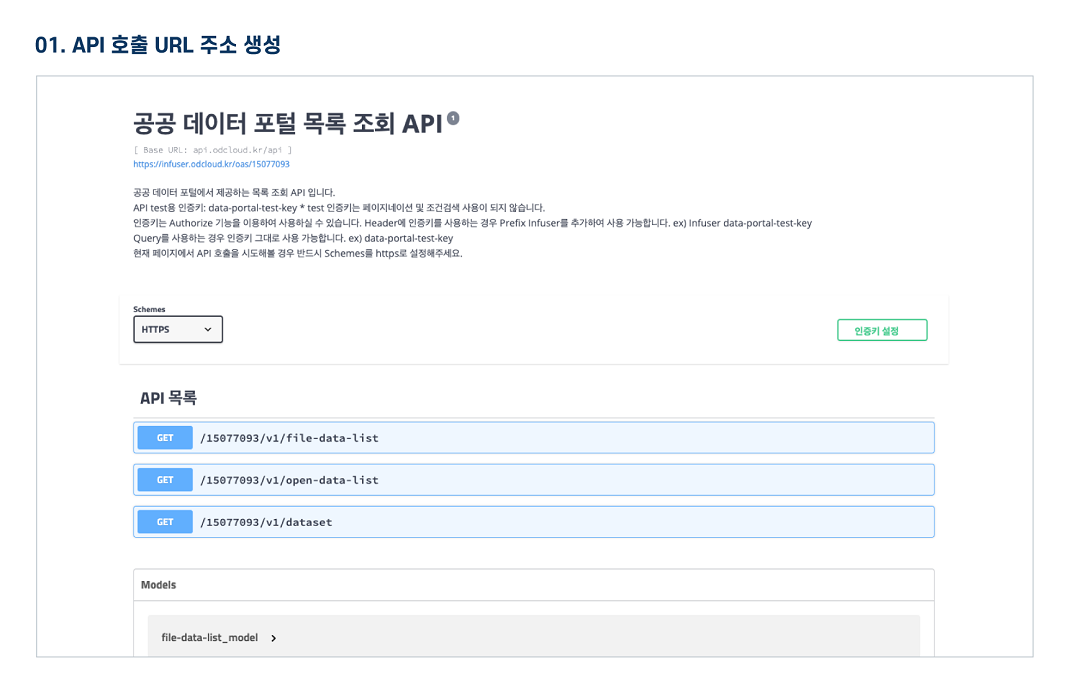

The Public Data Utilization Support Center automatically converts and provides open-format file data of three or more steps open to public data portals into open APIs (RestAPI-based JSON/XML).

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

Nonsan City, Chungcheongnam-do_1 Local tax burden per capita

File data information Download metadata Provides schema.org based metadata.

The Public Data Utilization Support Center automatically converts and provides open-format file data of three or more steps open to public data portals into open APIs (RestAPI-based JSON/XML).

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

To use the open API, you need to sign up for a public data portal membership and apply for utilization. For inquiries about utilization, please contact the Public Data Utilization Support Center.

File data can be used by downloading without logging in.

Nonsan City, Chungcheongnam-do_1 Local tax burden per capita

Open API Information Download metadata Provides schema.org based metadata.

| Service | Nonsan City, Chungcheongnam-do_1 Local tax paid per capita_20191231 | ||

|---|---|---|---|

| Classification System | Finance, tax, and finance - Detergent | Provider | |

| Management Agency | Public Data Utilization Support Center | Management agency phone number | 1566-0025 |

| Basis For Retention | Collection Method | ||

| Update Cycle | yearly | Next Enrollment Date | 2026-04-23 |

| Media Type | Text | Whole Row | 2 |

| Extension | XML, JSON | Application For Use | 2 |

| Data Limit | Keyword | local taxes,per capita,Burden,Local tax burden,duty | |

| Enrollment | 2023-01-30 | Correction | 2025-07-29 |

| Form Of Provision | Download from open data Portal (the original text file registration) | ||

| Explanation | This data provides per capita local tax burden data for Nonsan City, South Chungcheong Province. Key data includes city/province names, city/county/district names, local government codes, tax year, per capita burden, per household burden, total local tax, population, and number of households. This allows for quantitative analysis of the scale and trends of local taxes borne by Nonsan citizens and households. It is also useful for assessing regional fiscal soundness and understanding the level of resident burden and the structure of local tax revenue. This data serves as essential foundational data for various administrative fields, including fiscal policy formulation, revenue forecasting, resident welfare budgeting, and tax reform discussions. It provides transparent information disclosure to citizens and contributes to strengthening the fiscal accountability and policy responsiveness of local governments. | ||

| Other Notes | |||

| Payment | free | Charge Standard And Unit | Case |

| Scope Of Use | The use permission range limitless | ||

Usage Specification

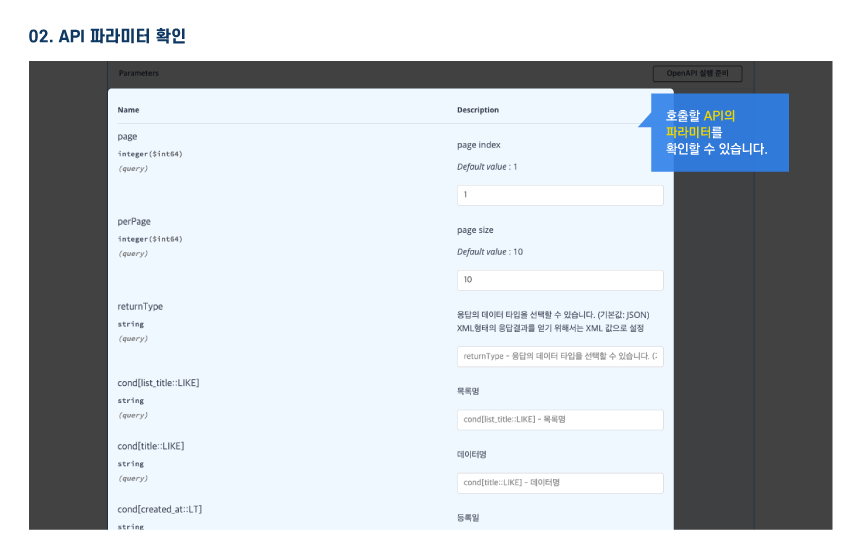

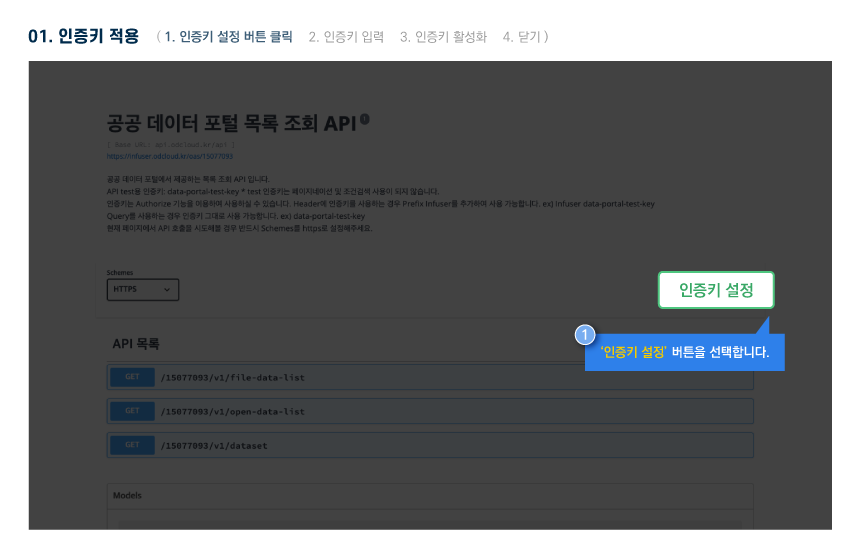

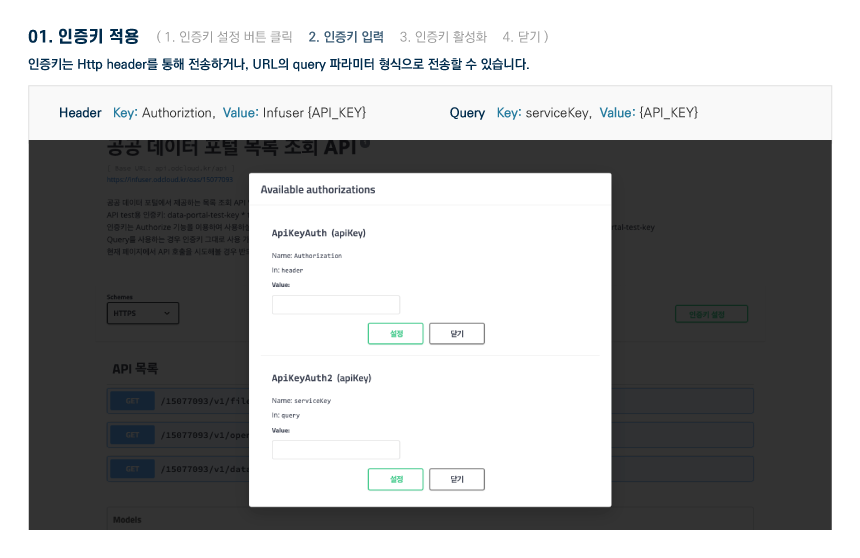

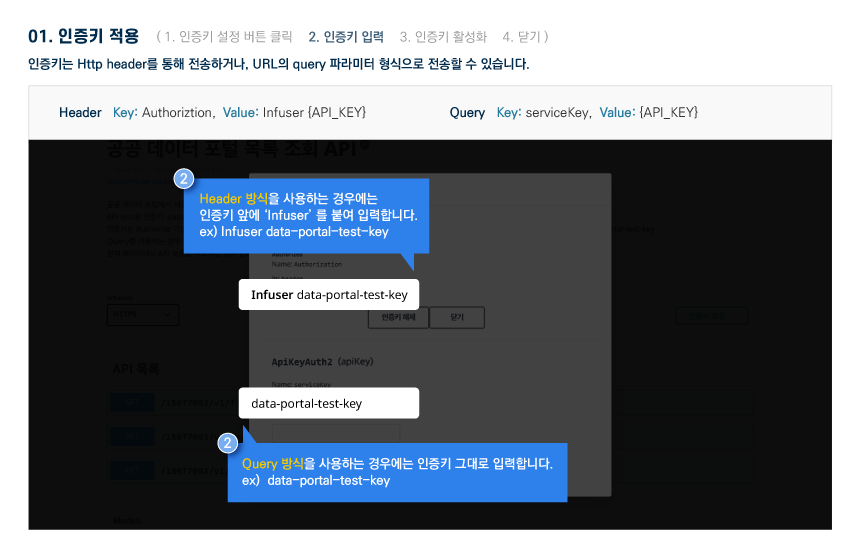

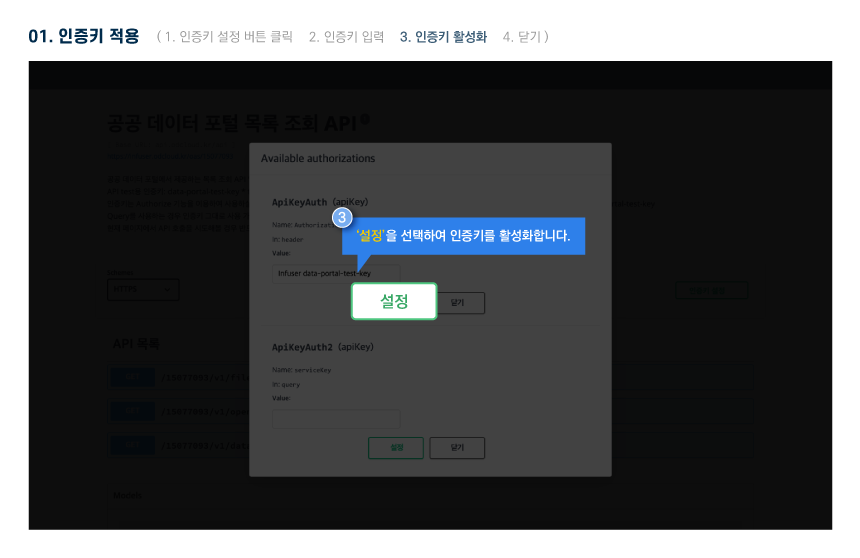

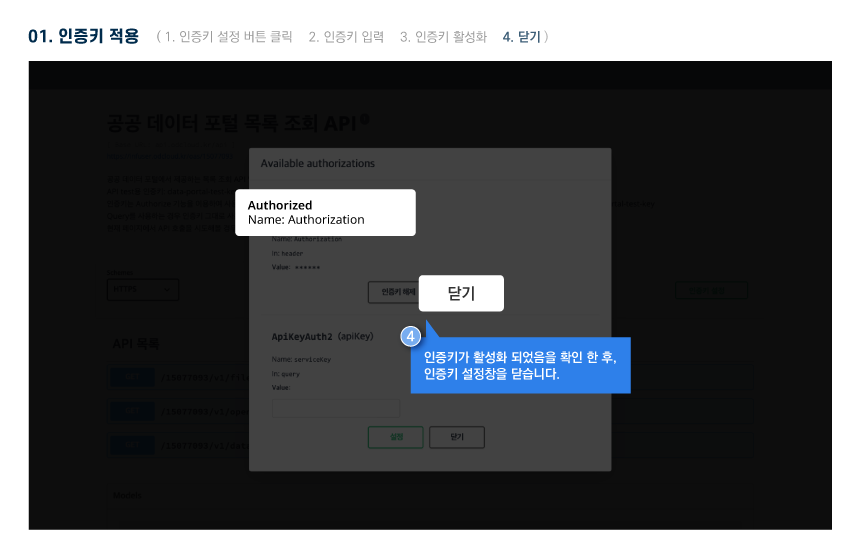

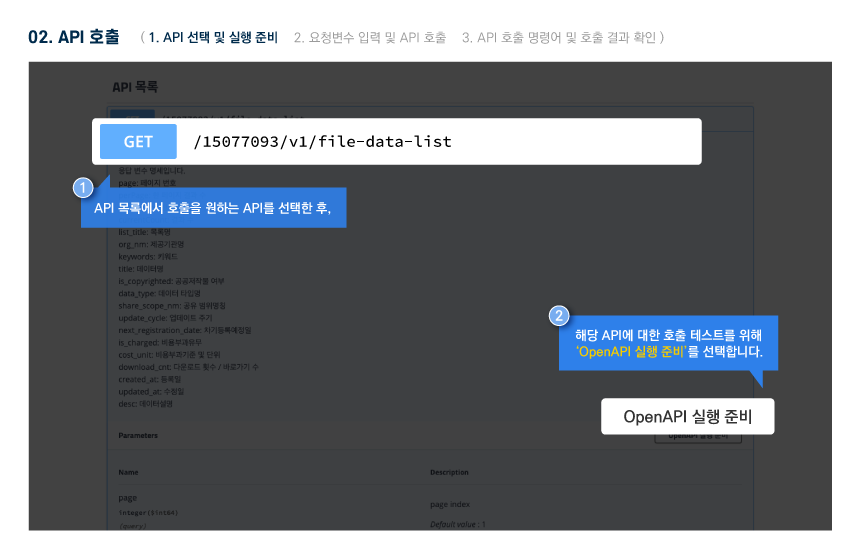

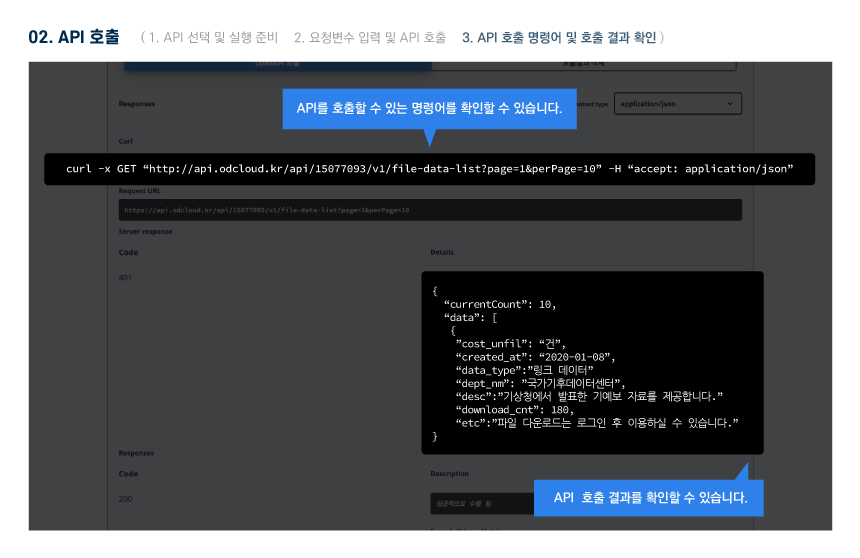

Open API 명세 확인 가이드